WhatsApp: The Operating System Powering Latin America's Fintech Revolution

Meeting customers where they are: The strategic advantage of using WhatsApp as a financial platform

In Latin America, WhatsApp has transcended its role as a messaging app to become the de facto operating system for a new wave of fintech innovation. With nearly universal adoption across the region—Brazil alone has 120 million users, making it WhatsApp's second-largest market globally—the platform provides an unparalleled foundation for financial services that traditional banking infrastructure has failed to deliver.

WhatsApp isn't merely another channel; it's becoming the primary interface through which millions of Latin Americans access, manage, and transact with financial services. This article explores how WhatsApp has emerged as the "OS" for Latin American fintech, the verticals being transformed, and what the future holds for this powerful convergence of messaging and finance.

The Perfect Storm: Why WhatsApp Dominates in Latin America

WhatsApp's dominance in Latin America stems from a combination of regional factors that created the perfect conditions for it to become the foundation for financial innovation:

Unprecedented User Penetration: WhatsApp usage in Latin America ranges from 80-90% of the population across major markets. In Brazil, 90% of the population uses WhatsApp daily, while in Mexico and Colombia, similar high penetration rates make it the digital common denominator across all demographics from urban millennials to rural elderly users.

Mobile-First Population: Latin America experienced a technological leapfrog, with many consumers bypassing desktop computing and moving directly to smartphones. In the last six years, smartphone usage in Mexico increased from 35% to over 50%, while internet penetration grew from below 50% to 70%. This mobile-first ecosystem aligned perfectly with WhatsApp's strengths.

Trust and Familiarity: A Mexican study found that 80% of users prefer communicating with businesses through WhatsApp due to its speed of response and inherent trust. This stands in stark contrast to the often low trust in traditional financial institutions across the region, particularly among unbanked populations.

Network Effect and Zero-Rating: Many mobile carriers in the region offer zero-rated WhatsApp data usage, meaning users can use the app without incurring data charges. This has further cemented WhatsApp as a daily utility across all socioeconomic segments.

Banking Gap: With approximately 26% of Latin Americans (122 million people) still unbanked as of 2021 according to World Bank data, there's enormous untapped potential for financial services that can reach this population through channels they already use.

WhatsApp as the Fintech OS: How It Works

Referring to WhatsApp as an "operating system" for fintech is metaphorical but increasingly accurate. The platform provides a unified environment where users can access a variety of financial services through a familiar interface, much like an OS provides a foundation for applications.

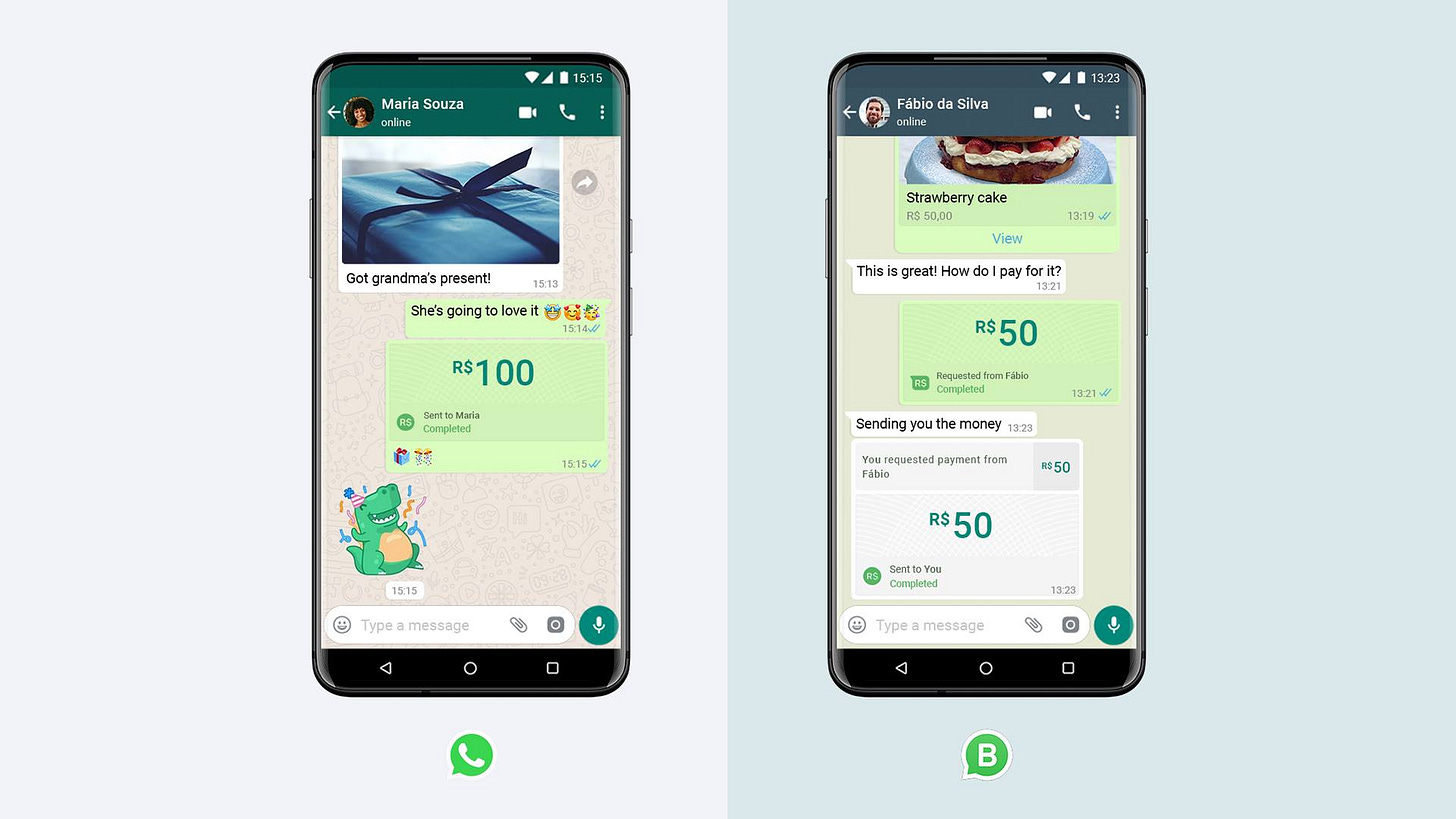

Fintech companies are building full-fledged services within WhatsApp—using the WhatsApp Business API, chatbots, and conversational user experiences—rather than developing standalone mobile apps or websites. This strategy transforms the chat thread into the primary user interface for banking, payments, lending, and more.

This OS-like functionality manifests in several ways:

Interface Layer: WhatsApp provides a consistent user interface with which nearly all Latin Americans are already familiar, eliminating the learning curve that comes with new financial apps.

Identity and Authentication: Phone numbers serve as user identifiers, with WhatsApp's verification serving as a first authentication layer.

Communication Backbone: The platform handles notifications, alerts, and real-time messaging, enabling both automated and human support.

Rich Media and Interactive Elements: Financial institutions can leverage WhatsApp's support for images, documents, voice notes, links, and interactive buttons to create sophisticated user experiences.

Distribution Channel: Rather than competing for downloads in crowded app stores, fintech services exist in users' WhatsApp contact lists, where they receive high visibility and engagement.

System of Record: WhatsApp conversations provide a permanent, chronological record of all financial interactions. This serves as a built-in transaction ledger that users can reference for proof of payments, loan terms, or account activities. The chat history effectively becomes a system of record that both customers and financial institutions can access, creating transparency and accountability without additional infrastructure.

Let's examine how this OS-like functionality is transforming key fintech verticals across Latin America.

Payments: The Leading Edge

The payments vertical has seen the most significant WhatsApp-driven innovation, particularly in Brazil with its instant payment system Pix:

Magie (Brazil): This AI-powered financial assistant enables users to send money and pay bills through WhatsApp. Users connect their bank accounts to Magie's service and can initiate transfers or payments by simply texting the WhatsApp bot using natural language or voice commands. Their tagline—"Use all your banks on WhatsApp"—encapsulates how the platform serves as a universal financial interface. Magie has processed over R$100 million (~$16.5M USD) in transfers via WhatsApp, demonstrating the viability of chat-based payment services.

Félix Pago (Mexico): Focused on cross-border remittances, Félix Pago built a WhatsApp-based chatbot allowing Latino workers in the US to send money home through simple message exchanges. Users can even use voice messages to instruct the bot whom to send money to and how much. This approach was so successful that Félix Pago raised a $15.5M Series A to expand, and even Nubank in Mexico partnered with them to power remittances for its 5.5 million users through WhatsApp.

WhatsApp Pay (Brazil): Meta's own payment solution has gained significant traction after regulatory approval. Telecom operator Claro now receives over 500,000 customer bill payments monthly through WhatsApp Pay via Pix. According to Claro's tech director, this channel has "generated a lot of efficiency and reduced costs," with customer satisfaction rates at 80% positive.

Merchant Payments: Beyond P2P transfers, startups are enabling in-chat payments to businesses. Many payment providers allow merchants to generate payment links sent via WhatsApp, bringing the checkout experience directly into the chat thread. This is proving particularly effective for small businesses operating in the informal economy.

Banking: The Full-Service Hub

Beyond payments, WhatsApp is becoming a comprehensive banking channel:

Tpaga (Colombia): This fintech offers "WhatsApp Banking" that allows users to perform many bank-like functions through chat. A user can text "Hi" to Tpaga's WhatsApp line, go through registration, and instantly have a digital account created. From that same chat, they can request to pay utility bills, top up mobile credit, and make purchases. Tpaga's CEO highlights that banks can save approximately 25% in customer service costs by handling interactions through WhatsApp.

Truora (Colombia): This startup became an official WhatsApp Business Solution Provider and offers a product helping banks and fintechs onboard and service users via WhatsApp. Their solution integrates identity verification, digital signatures, and customer support into a WhatsApp chat flow. During a pilot, users could initiate account opening by messaging a bank's WhatsApp line, with the chatbot requesting a selfie and ID photo for verification.

Technical Advantages of the WhatsApp-First Approach

Several factors make WhatsApp particularly effective as a fintech platform in Latin America:

Zero Installation Friction: By eliminating the need to download and install apps, WhatsApp removes a major adoption barrier. This is especially critical in markets where phone storage is limited or app store literacy is low.

Familiar, Low-Learning-Curve UI: The chat interface is one that users across all demographics already understand. There's virtually no learning curve—if you can send a text or voice note, you can use a WhatsApp-based financial service.

Asynchronous Convenience: WhatsApp allows users to engage at their own pace. A customer can start a process, pause to gather documents, and resume by simply continuing the chat—without losing progress.

High Engagement and Open Rates: WhatsApp messages have significantly higher open and response rates compared to emails or push notifications. According to Mozper, prospects engaging via WhatsApp were twice as likely to convert compared to other channels.

Personalized, Two-Way Communication: The conversational nature of WhatsApp enables personalized interactions. Bots can ask questions to tailor recommendations, and conversations can be escalated to human agents when needed—all within the same chat thread.

Rich Media and Interactive Elements: WhatsApp supports images, documents, voice notes, links, and interactive buttons, enabling sophisticated financial experiences without leaving the app.

The Future of WhatsApp as a Fintech Operating System

Looking ahead, several trends will shape WhatsApp's evolution as Latin America's fintech OS:

1. Deeper Integration with Regional Payment Systems

As instant payment infrastructures like Pix in Brazil and CoDi in Mexico mature, we can expect tighter integration with WhatsApp. The success of WhatsApp Pay in Brazil demonstrates the potential of these integrations. As similar payment systems emerge across the region, WhatsApp will likely become the primary interface through which users interact with national payment infrastructures.

2. Conversational AI Advancements

AI capabilities are rapidly improving the sophistication of WhatsApp-based financial assistants. We're already seeing this with services like Magie processing voice commands for transactions. Future iterations will handle increasingly complex financial tasks through natural conversation, from personalized investment advice to automated expense categorization and financial planning.

3. Cross-Vertical Integration

As the WhatsApp fintech ecosystem matures, we'll see greater integration across verticals. For example, a user might receive a loan through a lending service on WhatsApp, then automatically receive insurance offers for the purchased asset, followed by investment opportunities once the loan is repaid—all coordinated through different fintech providers but experienced as a seamless journey within WhatsApp.

4. Expansion Beyond Consumer Finance

While most current examples focus on consumer applications, WhatsApp is increasingly being adapted for SME financial services. Business owners in Latin America already use WhatsApp extensively for customer communications, making it a natural channel for business banking, merchant services, inventory financing, and other B2B financial products.

5. Regulatory Framework Evolution

Regulatory bodies across Latin America are adapting to this new paradigm. Brazil approved its Open Banking project in 2019, and other countries like Mexico have established frameworks for fintech companies to compete with traditional financial institutions. As regulations evolve to address WhatsApp-based services specifically, we'll see accelerated innovation and adoption.

6. Financial Infrastructure as a Service

Companies like Truora are already providing infrastructure that allows any financial institution to deliver services via WhatsApp. This "WhatsApp Banking-as-a-Service" trend will accelerate, enabling even traditional banks to quickly deploy sophisticated WhatsApp capabilities without extensive technical development.

7. Greater Consolidation of Financial Services

WhatsApp will increasingly serve as a financial super-app, where users can access diverse services from different providers through a unified interface. Rather than switching between apps, users will navigate between different WhatsApp business accounts for various financial needs, with each account effectively functioning as an "app" within the WhatsApp ecosystem.

Conclusion

WhatsApp's emergence as the operating system for Latin American fintech represents a fundamental shift in how financial services are conceived, delivered, and experienced in the region. By leveraging WhatsApp's ubiquity, trust, and familiarity, fintech startups are overcoming traditional barriers to financial inclusion and creating services that meet users where they already are.

The most successful fintech startups in Latin America today aren't asking users to download yet another app—they're building sophisticated financial experiences within the messaging platform that has already become part of users' daily lives. This approach is proving particularly effective in reaching the previously unbanked, driving Latin America's dramatic increase in financial inclusion from 55% in 2017 to 74% in 2021.

The strategic implications are clear: in Latin America, a WhatsApp strategy isn't optional—it's essential. Those who master the art of delivering financial services through this conversational medium will have a significant advantage in customer acquisition, engagement, and retention.

The future belongs to companies that can transform a simple chat thread into a comprehensive, compliant, and secure financial platform—turning WhatsApp from a messaging app into the true operating system of Latin American finance.

Sources

Andreessen Horowitz. "Latin America's Fintech Boom." A16Z. Brazil's statistics on WhatsApp usage (120 million users) and digital transformation in Latin America. https://a16z.com/latin-americas-fintech-boom/

Fintech Nexus. "Fintechs in Latin America Draw Venture Capital Interest, Again." Analysis of fintech investment trends in Latin America. https://www.fintechnexus.com/vc-latin-america-fintechs/

LatamList. "Five Reasons to Invest in Latin American Fintech." Overview of the Latin American fintech ecosystem and investment opportunities. https://latamlist.com/five-reasons-to-invest-in-latin-american-fintech/

TechCrunch. "All that fintech investment had a real impact on banking penetration in Latin America." Data on financial inclusion growth in Latin America. https://techcrunch.com/2023/09/01/latam-fintech-banking-penetration/

Inter-American Development Bank (IDB). "Study: Fintech Ecosystem in Latin America and the Caribbean Exceeds 3,000 Startups." Comprehensive study on the fintech ecosystem growth in Latin America. https://www.iadb.org/en/news/study-fintech-ecosystem-latin-america-and-caribbean-exceeds-3000-startups

FF News. "Best Insurance Launches WhatsApp Apply and Buy Service." Case study on insurance services via WhatsApp. https://ffnews.com/newsarticle/insurtech/best-insurance-launches-whatsapp-apply-and-buy-service/

FinTech Global. "An era of Latin American InsurTech growth." Overview of insurtech developments in Latin America. https://member.fintech.global/2022/03/21/an-era-of-latin-american-insurtech-growth/

The Digital Insurer. "Overview of the Insurtech Ecosystem in Latin America." Analysis of insurtech trends and regulatory environments in Latin America. https://www.the-digital-insurer.com/overview-of-the-insurtech-ecosystem-in-latin-america/

DashCX. "Exploring the possibilities of a WhatsApp API for banking and fintech." Technical overview of WhatsApp Business API applications in financial services. https://www.dashcx.com/blogs/exploring-the-possibilities-of-a-whatsapp-api-for-banking-and-fintech-dashcx/

BBVA Spark. "Financial inclusion in Latin America." Data on financial inclusion and the role of digital technologies. https://www.bbvaspark.com/contenido/en/news/fintech-entrepreneurship-to-drive-financial-inclusion-in-latin-america/

Silicon Valley Bank. "Latin America emerging as a global leader in fintech." Analysis of Latin America's fintech ecosystem and investment trends. https://www.svb.com/industry-insights/fintech/latam-emerging-as-a-global-leader-in-fintech/

International Monetary Fund (IMF). "The Rise and Impact of Fintech in Latin America." Research on fintech's macroeconomic impact in Latin America. https://www.elibrary.imf.org/view/journals/063/2023/003/article-A001-en.xml

Dealroom.co. "Fintech's hottest market: Latin America." Data on fintech funding and ecosystem development in Latin America. https://dealroom.co/blog/fintechs-hottest-market-latin-america

WebenGage. "10 Strategic Fintech WhatsApp Use Cases for Better Outreach." Examples of WhatsApp applications in financial services. https://webengage.com/blog/whatsapp-use-cases-for-fintech/

Forbes. “Whatsapp toma fuerza como escenario para pagos y servicios financieros en Colombia”. Examples of banking applications in Colombia. https://forbes.co/2024/02/28/tecnologia/productos-financieros-en-whatsapp