Wall Street's Favorite Punching Bag: How Nubank Keeps Bouncing Back

In the fintech world, there's a curious phenomenon unfolding that deserves our attention. Despite delivering extraordinary financial results, Nubank faced a puzzling market response to its Q4 2024 earnings. This disconnect between operational excellence and investor perception creates what might be the most compelling opportunity in the fintech landscape today.

Let's dive into what's really happening with Latin America's most successful fintech story.

The Numbers Don't Lie: Nubank's Record-Breaking 2024

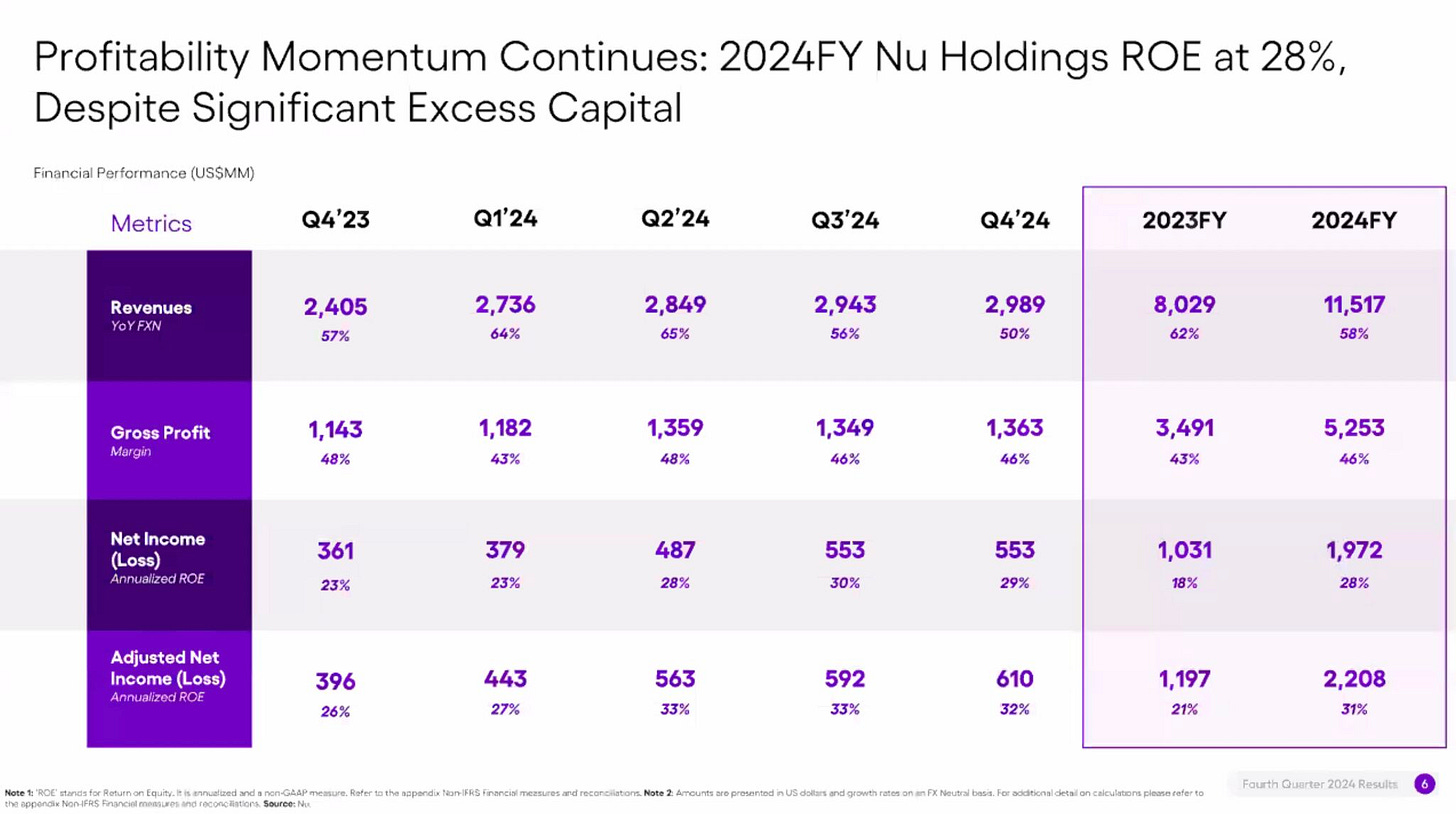

Nubank's 2024 performance defies conventional wisdom about what's possible in financial services. The company closed the year with $11.5 billion in revenue, growing almost 60% year-over-year, while nearly doubling earnings to $2 billion. This translated to a 28% return on equity—placing Nu among the most profitable financial institutions globally.

As CEO David Vélez noted in a recent interview, "We might be one of the few financial institutions in the world that manages to both grow top line at almost 60%, as well as generate a return on equity of 28% at the same time."

The customer metrics are equally impressive: Nubank added 20 million new customers, reaching 114 million across Brazil, Mexico, and Colombia, with an 83% activity rate. These aren't dormant accounts; they represent engaged customers using an average of 4.1 products each.

Meanwhile, the efficiency ratio dropped below 30% for the first time, hitting 29.9% in Q4 2024—better than most traditional banks and many fintechs. This operational efficiency remains one of Nubank's most underappreciated competitive advantages.

Beyond Brazil: Multi-Market Success Proves the Model Works

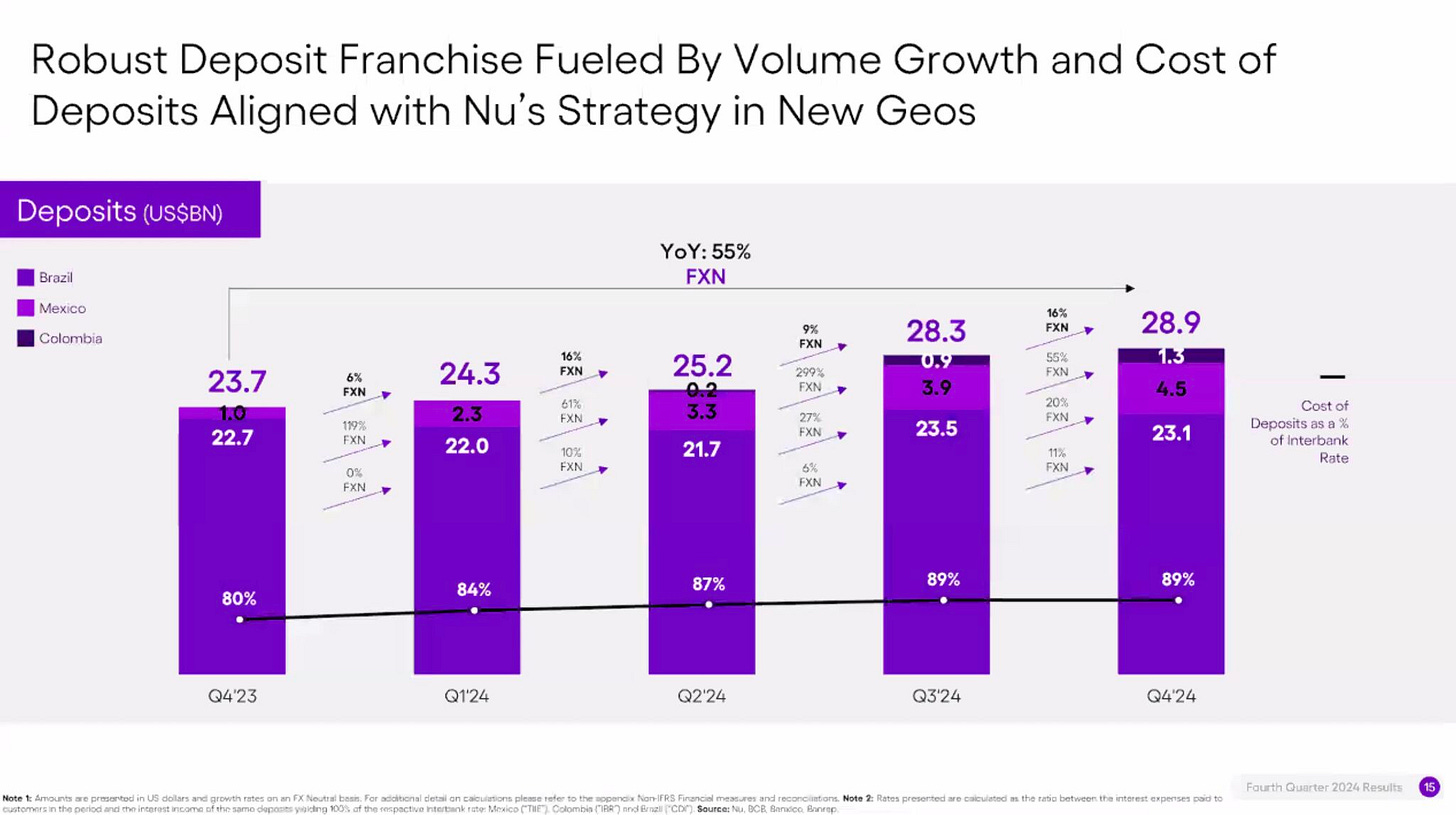

One of the most significant narratives of 2024 was Nubank's expansion beyond its Brazilian home market. Mexico nearly doubled its customer base, reaching 10 million customers and $4.5 billion in deposits. This validates the company's ability to replicate its model beyond Brazil—a critical proof point for a company with global ambitions.

"Mexico's success is undeniable," Vélez stated, "reaching 10 million customers (+91% YoY) and $4.5 billion in deposits, proving the model works beyond Brazil."

Colombia also showed promising early traction, reaching 2.5 million customers. This multi-market success story demonstrates that Nubank's advantages aren't tied to a single market's unique conditions but rather to fundamental business model innovation.

The Revenue Expansion Story: Depth Over Breadth

While Nubank continues to add millions of new customers, the more compelling growth story lies in customer monetization. Monthly ARPAC (Average Revenue Per Active Customer) increased 23% YoY to $10.7, with mature cohorts reaching approximately $25.

This contradicts the bear thesis that Nubank can't effectively monetize its massive user base.

As David Vélez explained: "Traditional banks have $40 per customer. Now, I don't think we're going to get to $40 per customer, because there are a lot of fees that banks charge that we won't charge, so maybe we won't get to 40, but maybe we get to 25, 30 at some point."

Even conservative assumptions about ARPAC expansion suggest significant growth runway. With only a 3% share of financial services revenue in Latin America, Nubank's ceiling remains far away.

Product Diversification Driving Growth

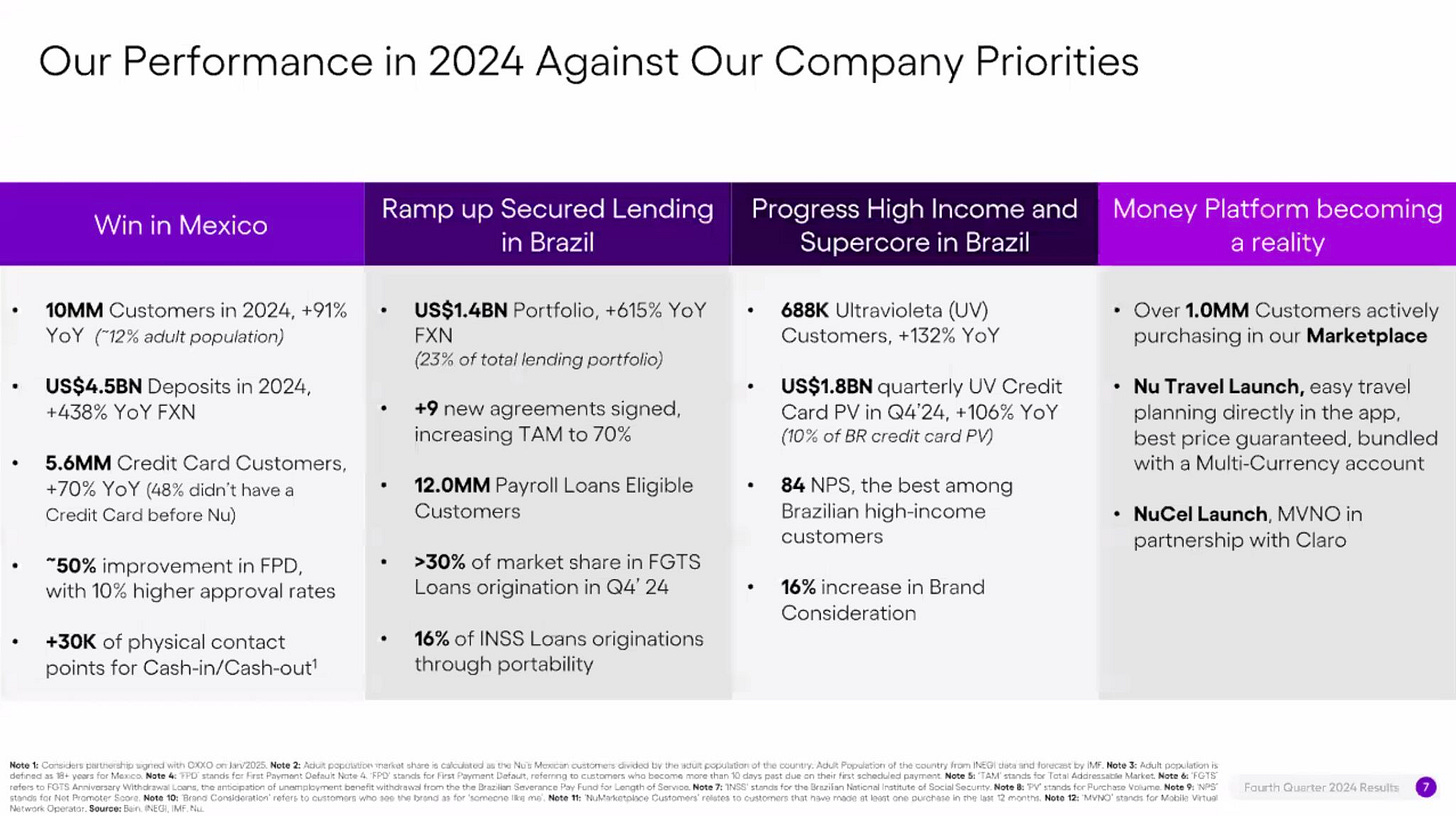

Nubank's 2024 strategy focused on four key priorities: Mexico growth, secured lending in Brazil, high-income customers, and expanding the "money platform" beyond traditional banking.

The secured lending initiative proved particularly successful, growing 615% YoY to $1.4 billion, demonstrating the company's ability to penetrate new product segments with favorable risk profiles. In the FGTS (Anniversary Withdrawal Loans) segment, Nubank captured over 30% market share of new originations.

Meanwhile, the high-income segment saw accelerated growth, with the premium Ultravioleta product reaching approximately 700,000 customers and an impressive 84% NPS. This success in higher-value segments contradicts the narrative that Nubank can only serve mass-market customers.

The company also began expansion beyond financial services, with over one million customers making marketplace purchases, along with new travel and mobile phone (NuCel) offerings.

As Vélez describes it: "As we get close to 60% of the Brazilian adult population, with hundreds of millions of customers, we have the opportunity to grow beyond financial services and launch new verticals and products."

The Three-Act Strategy: What's Coming in 2025

Nubank's vision extends well beyond its current achievements. The company has articulated a compelling "three-act" strategy:

Act One: Become the largest and most loved retail banking franchise in Latin America

Act Two: Expand beyond banking into other verticals where complexity can be eliminated

Act Three: Set foundations for global expansion and develop the "AI Private Banker"

For 2025, the company will continue strengthening its foundation in Brazil, Mexico, and Colombia while taking its first significant steps toward global expansion.

As Vélez put it: "2025 is going to be the first year where we finally start making the first these more significant steps towards going beyond Latin America and thinking about a world where Nubank is more of a multi-country, multi-region, multi-continental, technology company."

The "AI Private Banker" vision is particularly intriguing—aiming to democratize financial advice in a way that could fundamentally reshape financial services:

"It is giving the experience that the top 1% today has in financial services to the bottom 50%. It is every single person around the world having a private banker that grabs your hand and tells you... this is the right product you should be investing."

The Market Disconnect: Short-Term Focus vs. Long-Term Value

Despite these results, Nubank's stock experienced a 17% drop following its Q4 earnings report that hasn't fully recovered. This disconnect likely stems from a handful of factors:

An EPS shortfall (actual $0.11 vs. estimated $0.12) overshadowing the bigger picture

Concerns about Brazil's macroeconomic environment and potential saturation

Misunderstanding of Nubank's multi-market strategy and growth vectors

Fixation on short-term metrics rather than long-term value creation

As David Vélez notes: "I think there are both. I mean, there are investors that are asking for the next quarter. There are investors that are asking for the next ten years. We like the investors that are asking about the next 5 to 10 years."

2025 Predictions: What to Watch

Based on the financial results, strategic direction, and management commentary, here are the key developments I expect for Nubank in 2025:

Global Expansion Announcement: Expect formal announcement of Nubank's first market(s) outside Latin America by the end of 2025, likely targeting other emerging markets with similar banking challenges -> Nubank is targeting the African and Southeast Asian markets by investing in Tyme with a lead check of $150M for 10% equity, valuing the Singapore-based startup in $1.5 billion.

ARPAC Continuation: Monthly ARPAC should continue its upward trajectory toward $12-13, driven by deeper customer relationships and product expansion.

Mexico Scale: Mexico will likely cross 15 million customers and become a meaningful contributor to overall profitability.

Beyond Banking Acceleration: The "Act Two" strategy will accelerate with more meaningful contributions from non-banking verticals like travel, telecommunications, and e-commerce.

AI Implementation: Early versions of the "AI Private Banker" will begin appearing in the app, initially focused on guiding investment decisions and financial education.

Deposit and Lending Growth: Expect continued 40%+ growth in both deposits and the lending portfolio, with secured lending becoming an increasingly important component.

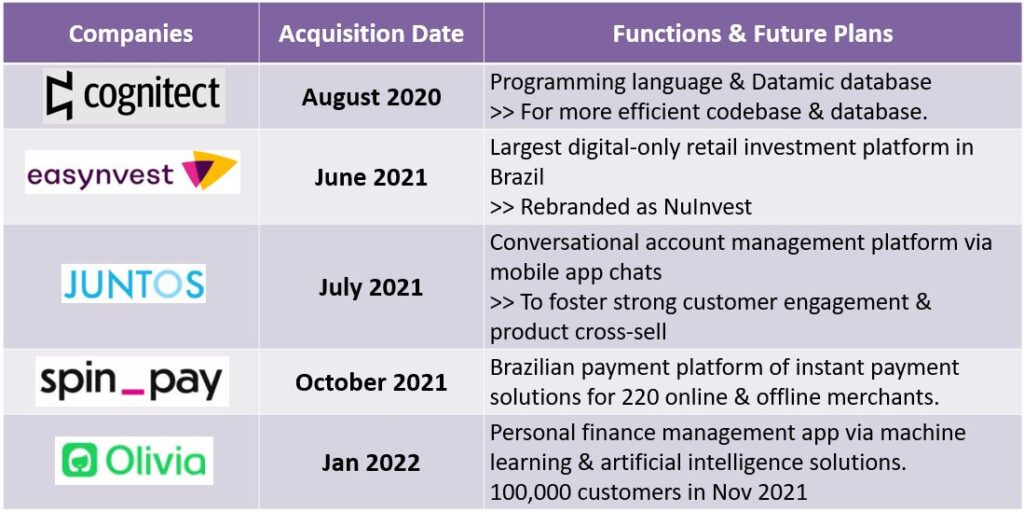

M&A Activity: As global expansion begins, targeted acquisitions to accelerate technology capabilities or market entry become more likely -> Nubank's latest acquisition Hyperplane aligns with its "Act Three" strategy of AI-driven bank

The Long Game: Why Nubank Will Win

While short-term market sentiment remains volatile, Nubank's fundamental advantages position it for long-term success:

Superior Cost Structure: With a monthly cost-to-serve of less than $1 per customer versus $15-20 for traditional banks, Nubank can profitably serve segments that incumbents cannot.

Virtuous Growth Cycle: Low customer acquisition costs enable investment in product development, which drives engagement, which improves monetization.

Technology Advantage: By building its own core banking system and key infrastructure, Nubank maintains structural advantages in agility and cost efficiency.

Unique Growth Profile: Few financial institutions can deliver both high growth and high profitability simultaneously.

Customer Love: With industry-leading NPS scores and high engagement rates, Nubank benefits from strong word-of-mouth growth and customer loyalty.

As Vélez puts it: "In 11 years our cost to serve our customer hasn't really increased, it's less than $1 per customer. While, yes, more products mean more complexity, we get significant economies of scale. We have a lot of our own technology."

Conclusion: The Most Misunderstood Financial Success Story

Nubank represents a rare opportunity in financial services—a company delivering both extraordinary growth and exceptional profitability at scale, yet still trading at a discount to its long-term value.

For those following Latin American fintech, the question isn't whether Nubank can execute—they've proven that consistently. The question is whether investors will eventually recognize the extraordinary business being built, or continue focusing on short-term metrics.

As the gap between operational performance and market valuation persists, those who understand Nubank's true potential may find themselves looking at perhaps the most compelling opportunity in the fintech landscape today.

This article is not investment advice. This analysis is based on Nubank's Q4 2024 earnings release, financial statements, and public comments from CEO David Vélez. What's your take on Nubank's trajectory? Reply to this newsletter with your thoughts.