The Selection Imperative: Why Emerging Markets Reward Precision Over Diversification

A decade of Latin American data reveals how opportunity scarcity forces a fundamentally different investment approach than mature markets

The venture capital orthodoxy is clear: diversification reduces risk. Dave McClure, founder of 500 Startups, famously argued that if unicorns happen 1-2% of the time, "it is logical to adopt a portfolio size that includes at least 100 companies" to maximize the chance of investing in that mystical unicorn. The math seems sound: cast a wide net, and you're more likely to catch the big fish.

But a decade of Latin American Series A data tells a radically different story. The most successful investors in the region aren't the ones following diversification strategies. They're the ones who've mastered the art of selection because in emerging markets, there simply aren't enough high-quality opportunities to diversify meaningfully.

While this analysis focuses specifically on Latin America, it suggests that emerging markets may operate under fundamentally different dynamics than mature venture ecosystems, potentially challenging conventional assumptions about optimal portfolio construction.

Welcome to Emerging Fintech 👋🏻, your weekly deep dive into venture capital and fintech across emerging markets. If someone forwarded this to you, subscribe to get insights like this delivered weekly.

This edition is sponsored by Angel Squad - Join 2,000+ investors learning to find outliers in early-stage startups. Get access to Hustle Fund's curated deal pipeline, weekly educational sessions, and a global community of angel investors. Try Angel Squad free for 30 DAYS → https://go.angelsquad.co/gBk0

The Selection Champions

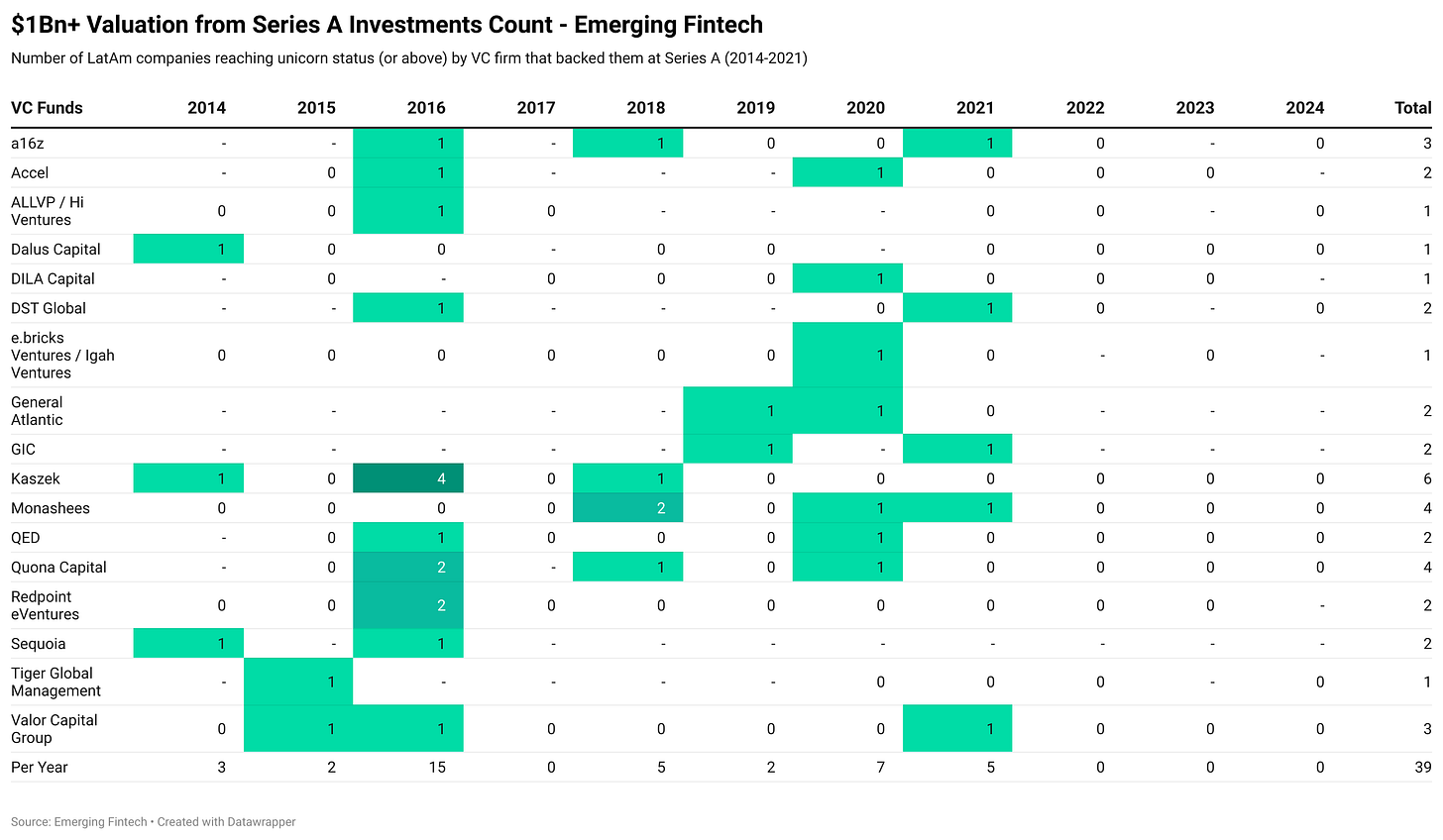

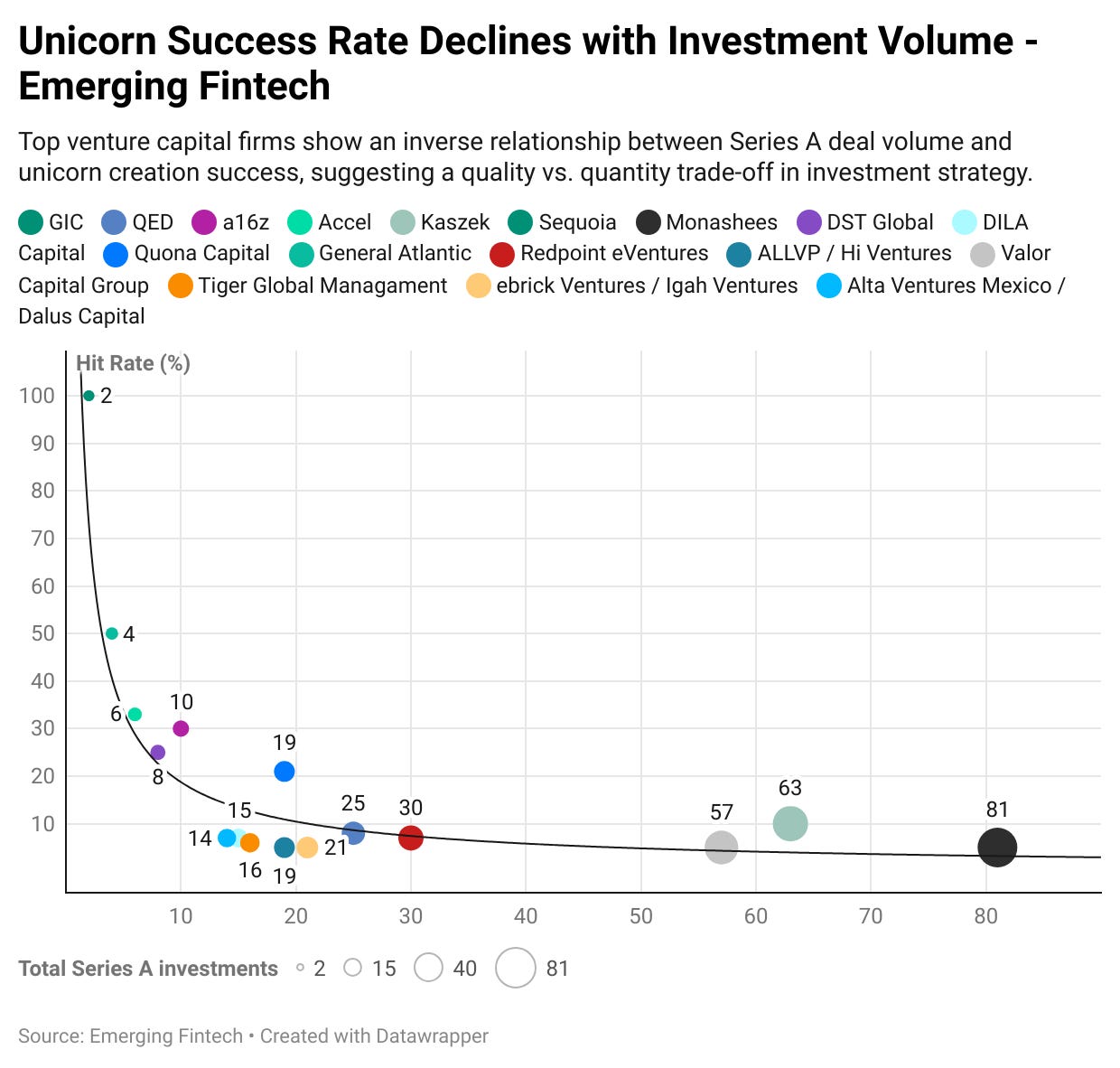

Consider the starkest example: Sequoia Capital made exactly two Series A investments in Latin America between 2014-2024. Both became unicorns. Nubank (valued at $61B) and Rappi (valued at $5.25B). That's a 100% hit rate achieved through surgical precision, not portfolio diversification.

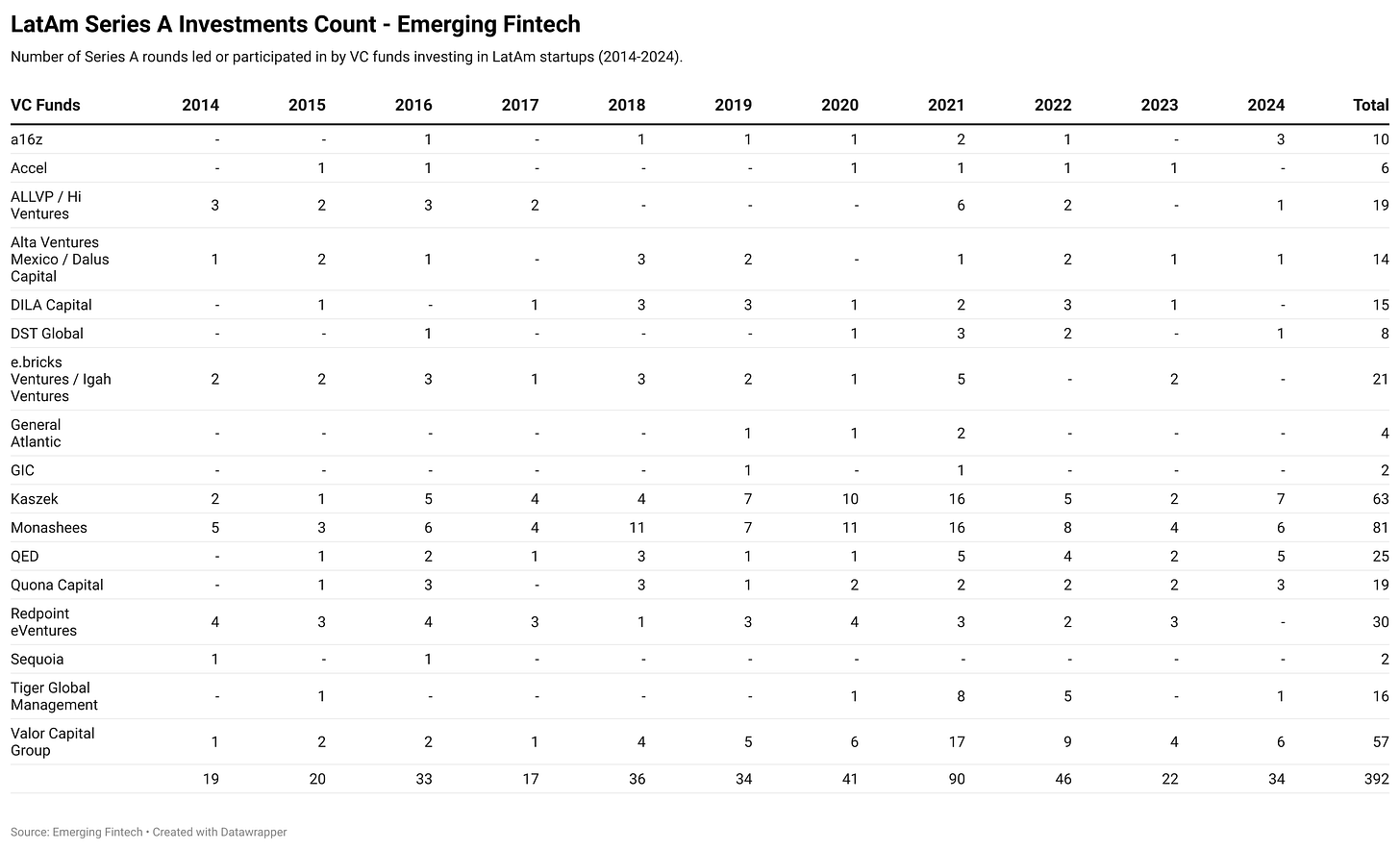

Compare this to high-volume local approaches:

Monashees: 81 investments → 4 unicorns (4.9% conversion)

Kaszek: 63 investments → 6 unicorns (9.5% conversion)

Valor Capital Group: 57 investments → 3 unicorns (5.3% conversion)

The pattern reveals a strong negative correlation (-0.566) between portfolio size and hit rate—exactly the opposite of what diversification theory would predict. When you dig into the numbers, something fascinating emerges.

Highly Selective (2-4 investments):

Sequoia: 2 investments → 100% hit rate

GIC: 2 investments → 100% hit rate

General Atlantic: 4 investments → 50% hit rate

Moderately Selective (6-19 investments):

Accel: 6 investments → 33% hit rate

a16z: 10 investments → 30% hit rate

Quona Capital: 19 investments → 21% hit rate

High Volume (25+ investments):

QED: 25 investments → 8% hit rate

Redpoint eVentures: 30 investments → 7% hit rate

Kaszek: 63 investments → 10% hit rate

Monashees: 81 investments → 5% hit rate

When the global average for unicorn creation is 0.5-2.5%, seeing multiple funds achieve 30-100% hit rates suggests they're not just outperforming. They're operating in a fundamentally different opportunity environment that rewards selection over diversification.

This raises an important question: What if the conventional wisdom about portfolio construction doesn't apply universally?

Why Emerging Markets Break the Diversification Model

Dan Gray's mathematical analysis, featured on TBPN where he spoke about portfolio construction in VC, makes a compelling case for diversification. Drawing on data from CB Insights, AngelList, and Stanford, he demonstrates that unicorn outcomes occur in just 0.5-2.5% of seed-stage investments.

Gray's argument is mathematically sound: "There's a ~0.5–2.5% chance that a venture backed company, at seed, will produce a unicorn outcome." He cites multiple sources supporting this range: "Ilya Strebulaev (GSB Professor & Researcher): 0.5%, AngelList (Top Startup & VC Fundraising Platform): 2.5%, CBinsights (Top Startup & VC Research Firm): 1.28%."

His core thesis is that since "most VCs are willing to admit they really can't predict which of their investments will be a winner," the solution is portfolio construction over picking. Gray argues that "if we verge towards generous and assume a 2% hit rate, the conclusion should be that seed managers should probably target at least 50 investments, to optimise for at least one unicorn."

Through portfolio modeling, Gray demonstrates that diversified approaches (100 investments) consistently outperform concentrated ones (20 investments) across multiple metrics, concluding that "VCs cannot reliably pick winners. They can, however, construct portfolios that consistently generate great returns."

But these assumptions break down completely in emerging markets like Latin America:

Opportunity Scarcity: LatAm produced only 39 unicorns over 10 years (3.9 per year average), with three consecutive years (2022-2024) producing zero billion-dollar outcomes. Gray's diversification model assumes abundant opportunities where you can realistically deploy 50-100 investments. In emerging markets with severe scarcity, diversifying across 100+ companies becomes mathematically impossible when there are only 3-4 real unicorn opportunities per year.

Non-Uniform Distribution: The opportunities aren't evenly distributed over time. In 2016, LatAm produced 15 unicorns; in 2017, zero. This boom-bust cycle means timing and selection matter exponentially more than diversification. Unlike mature markets where Gray's baseline applies broadly across hundreds of opportunities, emerging markets exhibit extreme winner-take-all dynamics that defy statistical modeling.

Infrastructure Gaps: Gray's diversification theory assumes follow-on capital and market infrastructure exist to support portfolio companies through multiple rounds. In emerging markets, these often don't exist, making initial selection and intensive support far more critical than portfolio breadth. The mathematical assumptions underlying diversification theory simply don't hold when the supporting ecosystem is absent.

The opportunity gap becomes even starker when compared to mature markets. According to Tracxn data, the US alone produced 974 unicorns from 2014-2024—an average of 88.5 per year. This means the US produces 22.6x more annual unicorn outcomes than Latin America (88.5 vs 3.9 per year), creating the abundant opportunity environment that Gray's diversification model requires.

The math tells a clear story about opportunity density—mature markets like the US provide abundant opportunities that theoretically support diversification strategies, while emerging markets like Latin America simply don't have enough high-quality opportunities to make diversification mathematically viable.

Enjoying these insights? Hit the share button to spread the word.

A Counterpoint: Even Mature Markets Reward Selection

But here's where it gets interesting: even in mature markets with abundant opportunities, selection often outperforms diversification.

Martin Mignot, Partner at Index Ventures, revealed compelling data on the 20VC podcast with Harry Stebbings that challenges Gray's diversification thesis even in mature markets. Despite operating in opportunity-rich environments like the US and Europe, Index maintains a highly concentrated approach that has generated exceptional returns.

"We've been around for 30 years. We invested 11.5 billion. We've returned close to 30 and we still have 20 plus in holdings," Mignot disclosed. "Most of that is basically concentrated in eight nine companies. We've invested in probably 300 close to 400 companies over the years."

The math is striking: 8-9 companies driving returns out of 400 total investments represents a 2.25% concentration rate—remarkably close to Gray's cited unicorn baseline rates, yet achieved through selective entry rather than portfolio construction after the fact.

Index's stage breakdown reveals their concentrated approach: "Seven out of 10 Index's investments originated at Seed or Series A (55% when excluding Seed)." This translates to approximately 126 seed investments (4.2 per year) and 154 Series A investments (5.1 per year) over 30 years—far below Gray's recommended 50+ annual investments, even while operating across multiple geographies.

Their selectivity has paid off dramatically. Index's lead Series A investment in Revolut generated approximately ~2,500× returns. Index leading Figma's seed round returned 18x their entire fund size. These outcomes weren't achieved through broad diversification, but through surgical precision in company selection.

Like this deep dive? Subscribe for weekly emerging market analysis.

The Thiel Fellowship provides another compelling data point: backing just 20 fellows per year, they achieve a 5.9% unicorn rate. This is nearly 3-10x higher than the baseline rates Gray cites for broad market performance. Their concentrated approach in a mature market (primarily US) demonstrates that selectivity can dramatically outperform broad diversification even when opportunities are abundant.

In public markets, the same pattern emerges: just 7 companies (the "Magnificent 7") drove most S&P 500 returns while 493 companies barely moved. Concentration of value appears to be the rule, not the exception, across all asset classes.

What This Reveals About Market Structure

As Latin American startup valuations compressed post-2022, the advantages of selective strategies became more apparent. In a market where follow-on funding became scarce and survival required excellence, portfolio companies needed investors who could provide more than capital.

The global VCs who maintained strong performance through the recent downturn did so precisely because their selective approach generated returns that justified continued LP support. Meanwhile, many high-volume local funds faced challenges raising new capital as their diversified portfolios showed limited differentiation in performance.

This data doesn't diminish the important ecosystem-building role that local VCs play. However, it does reveal objective patterns about how market structure shapes optimal investment approaches.

The venture capital consensus favoring diversification developed in mature markets with abundant opportunities and established support infrastructure. But in emerging markets like Latin America, where opportunities appear more scarce and success requires intensive support, selection emerges not just as an alternative strategy, but as a demonstrably effective approach based on the available performance data.

The question for the industry isn't whether selection is theoretically superior to diversification across all markets. The question is understanding when and where each approach tends to generate the best risk-adjusted returns for the specific market structure at hand.

In markets with opportunity abundance and robust infrastructure, diversification may indeed be optimal. But in markets characterized by scarcity and concentration, the data suggests that precision beats breadth.

This has implications beyond Latin America. Any market with limited high-quality opportunities (whether due to geography, sector maturity, or capital constraints) may reward selection over diversification. The key is recognizing which environment you're operating in and adapting your strategy accordingly.

Because ultimately, the market doesn't care about your investment thesis. It only cares about results.

Finding the right company and being selective is what drives returns at the end of the day. The concentration of value in venture capital is universal. The question is whether you achieve it through careful selection or hope to stumble into it through diversification.

If you found value in this analysis, share it with fellow investors and subscribe for weekly insights.

Disclaimer: The views and analysis presented in this article are entirely my personal opinions and should not be construed as investment advice or recommendations. This content is for informational and educational purposes only. All data interpretations, conclusions, and investment strategy assessments reflect my individual perspective and may not represent the views of any organization or institution. Readers should conduct their own research before making any investment decisions.

Sources and Data

Latin American VC Series A data (2014-2024) by Emerging Fintech

Dan Gray Twitter thread on portfolio concentration: https://x.com/credistick/status/1790475066843083230

Dave McClure: "99 VC Problems But A Batch Ain't One: Why Portfolio Size Matters For Returns"

Ulu Ventures: "Picking Winners Is A Myth"

AngelList: "What Percentage of AngelList Seed-Stage Startups Become Unicorns?"

Ilya Strebulaev LinkedIn post: "Unicorn Probability by Funding Round" (Stanford research)

CB Insights: "Your Startup Has a 1.28% Chance of Becoming a Unicorn"

CB Insights: "The Venture Capital Funnel"

OpenLP/Jessica Archibald post on fund returners: https://x.com/Open_LP/status/1877099984283123851

Harry Stebbings post on predicting outcomes: https://x.com/HarryStebbings/status/1918761235459297622

Sequoia Capital Nubank profile: https://www.sequoiacap.com/companies/nubank/

Sequoia Capital Rappi profile: https://www.sequoiacap.com/companies/rappi/

Sequoia Capital: "The Latin American Startup Opportunity" - 2024

Index Ventures performance data: Martin Mignot interview on 20VC podcast with Harry Stebbings

Tracxn: Unicorn startups in the United States (August 2025)