Nubank is crushing every neobank worldwide. Here's the data that proves it.

Q1 2025: $3.25B revenue, $557M profit, 118.6M customers. These aren't regional numbers—they're global dominance.

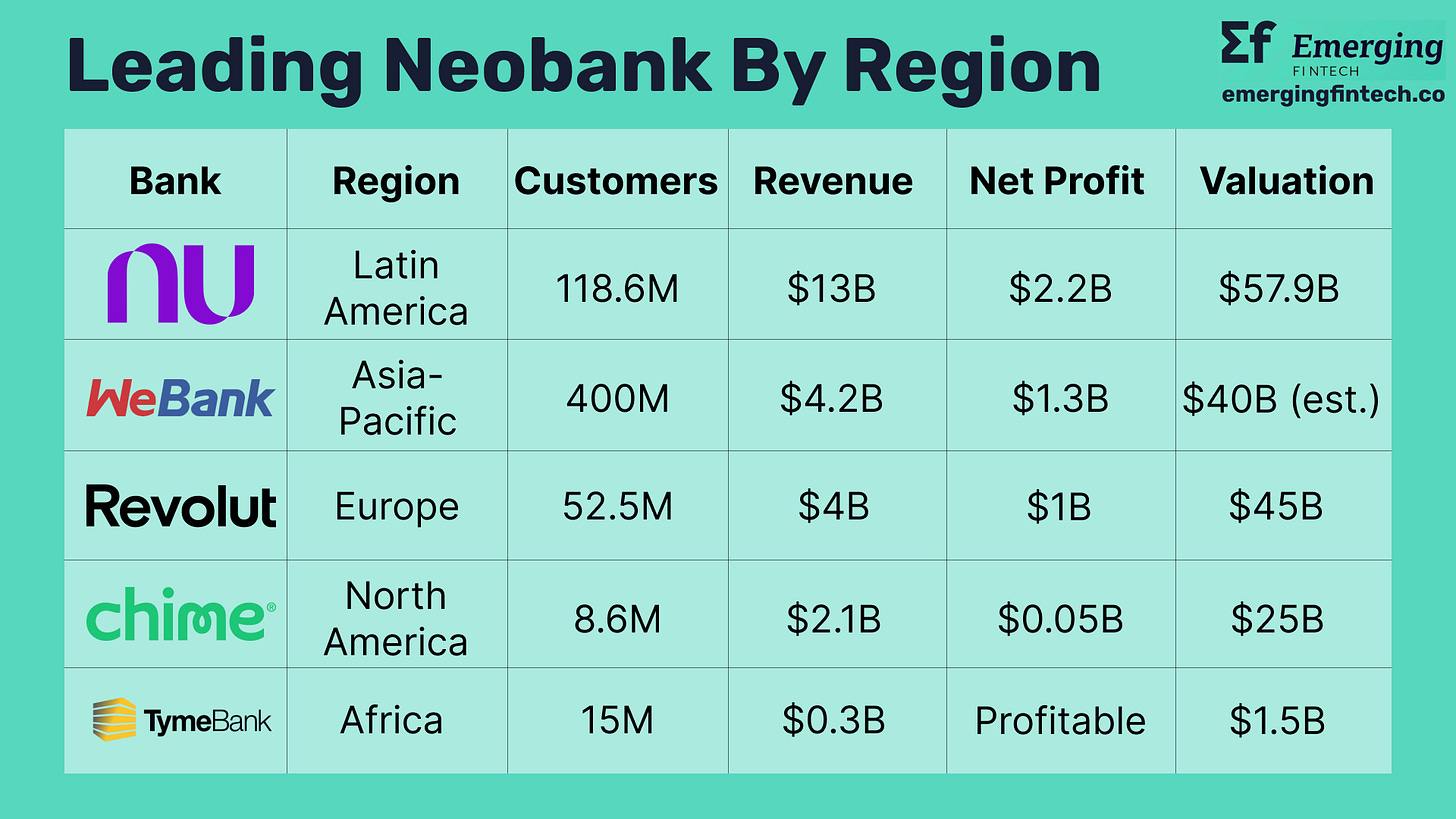

While the fintech world obsesses over Revolut's global expansion and celebrates Chime's recent path to profitability, the real story of digital banking dominance has been unfolding 5,000 miles south of Silicon Valley. When Nubank launched its first credit card in Brazil in 2014, few predicted this São Paulo startup would become the world's most profitable neobank within a decade. Yet the latest Q1 2025 results reveal something remarkable: Nubank now serves 118.6 million customers, generates $13 billion in annualized revenue, and posts profits that dwarf every competitor globally.

The numbers are staggering enough to make any Silicon Valley founder weep. Nubank's quarterly profit of $557 million is 44 times larger than Chime's entire $12.7 million quarterly profit—despite Chime finally achieving profitability after a decade of losses. Nubank generates more revenue than Revolut and Chime combined, while maintaining an efficiency ratio of 24.7% that puts traditional banks to shame.

The uncomfortable truth? The biggest neobank success story isn’t happening where everyone's looking.

When the Data Destroys the Narrative

Nubank vs. WeBank: Quality Over Quantity

WeBank serves an impressive 400 million customers—more than triple Nubank's base. But here's where Nubank's brilliance shows: Nubank generates $110 revenue per customer annually while WeBank manages just $10.50. This isn't just a difference in markets—it's a masterclass in business model selection.

While WeBank focused on financial inclusion through micro-lending to China's underbanked masses, Nubank chose the credit card route in Brazil's high-interest environment. The result? Nubank produces 3x more revenue and 70% more profit despite serving one-third the customers. WeBank built impressive scale; Nubank built a money-printing machine.

Nubank vs. Revolut: Simplicity Beats Complexity

Revolut wins on features—crypto trading, travel insurance, business banking, investment products. It's a financial super app with over 50 million customers across multiple continents. Yet Nubank generates 3.25x more revenue while serving just 2.3x more customers.

The secret? Nubank's laser focus on credit products. While Revolut diversified into lower-margin services, Nubank mastered what actually drives banking profitability: interest income from credit cards and personal loans. 84% of Nubank's revenue comes from interest income, creating predictable, high-margin cash flows that Revolut's diversified model can't match.

Nubank's efficiency ratio of 24.7% means just 25 cents of every revenue dollar goes to operating costs. Revolut doesn't disclose this metric, but their need to maintain operations across dozens of countries with hundreds of different products suggests significantly higher operational complexity and costs.

Nubank vs. Chime: David and Goliath Reversed

This comparison is almost unfair. Nubank's quarterly profit of $557 million exceeds Chime's entire annual profit by more than 10x. Chime spent a decade burning cash in America's competitive banking market before achieving razor-thin quarterly profits of $12.7 million on $519 million in revenue—a 2.4% profit margin that's frankly embarrassing for a "tech company."

Nubank achieves a 17% profit margin while serving 14x more customers. The contrast highlights what happens when you choose the right market at the right time versus fighting over scraps in a saturated market. Chime's customer acquisition costs historically exceeded $100 per user; Nubank's remain around $5-7 while serving a much larger population.

The Brazilian Advantage That Changes Everything

These competitive advantages didn't happen by accident. Nubank entered a market where traditional banks were charging some of the world's highest fees while leaving 30% of adults completely unbanked. Interest rates in the 15-20% range created massive margins for those who could master credit underwriting. Less competition meant easier customer acquisition and higher retention.

Compare this to Chime's challenge: entering a market where traditional banks like Chase already offer competitive digital experiences, where regulatory restrictions limit fee income, and where customers already have established banking relationships. Nubank found a greenfield; Chime entered a war zone.

Even WeBank, despite its impressive technical capabilities, operates in a fundamentally different model. China's focus on financial inclusion means serving customers with limited ability to pay, requiring massive scale to achieve profitability. Nubank serves middle-class Brazilians with higher purchasing power and credit needs, generating superior unit economics from day one.

The Strategic Masterstroke: Buying Into Africa

In December 2024, Nubank executed what may prove to be the most strategically brilliant move in fintech history. Rather than burning billions trying to crack new markets like so many failed expansions, Nubank led a $250 million investment in TymeBank, securing a 10% stake in Africa's fastest-growing digital bank at a $1.5 billion valuation.

This move demonstrates strategic thinking that competitors like Revolut completely miss. Instead of expensive direct expansion, Nubank gains exposure to Africa's massive growth potential through a proven local champion. TymeBank mirrors Nubank's trajectory: serving underbanked populations, achieving rapid scale, and reaching profitability in just four years.

The knowledge transfer potential is extraordinary. As Nubank founder David Vélez explained: "We are excited to work with Tyme to share many of our learnings of scaling this model to hundreds of millions of customers." Nubank's operational expertise could accelerate TymeBank's growth while providing geographic diversification without execution risk.

TymeBank has stated its target to IPO in New York by 2028, potentially generating significant returns on Nubank's investment while validating this partnership approach for future expansion. If successful, Nubank could replicate this strategy across other high-growth markets, building a portfolio of regional champions rather than attempting costly direct expansion.

Why the Market Still Doesn't Get It

Despite crushing every competitor in revenue, profit, and efficiency, Nubank trades at just 4.5x revenue while Revolut commands an 11.25x multiple. This valuation gap reflects persistent bias toward Western companies despite inferior financial performance.

The market continues to price in Revolut's "global expansion potential" while ignoring that Nubank already serves more customers than Revolut across three countries and generates superior returns. Meanwhile, Chime's recent IPO filing at a $25 billion valuation—despite barely achieving profitability—shows how disconnected valuations remain from actual business performance.

Nubank's Q1 2025 results should be a wake-up call: $3.25 billion in quarterly revenue, $557 million in quarterly profit, 118.6 million customers, and a 24.7% efficiency ratio. These aren't the metrics of a regional player—they're the numbers of the world's most successful neobank, period.

The Future Belongs to Nubank

As Nubank approaches $13 billion in annual revenue with $2.2 billion in profit, while competitors struggle with razor-thin margins or continued losses, the competitive landscape becomes clear. Nubank didn't just build a successful neobank—it built the template for how digital banking should work.

The TymeBank investment signals that Nubank isn't content with regional dominance. By partnering with proven champions in other high-growth markets, Nubank is building a global emerging markets fintech coalition while competitors fight over saturated Western markets.

For investors, operators, and observers who missed Nubank's rise while focusing on London and San Francisco, the implications are sobering. The world's most successful neobank has been hiding in plain sight in São Paulo, generating returns that make every Western competitor look like a rounding error.

The purple giant from Brazil didn't just build a bank—it proved that choosing the right market matters more than having the most features, the biggest marketing budget, or the most prestigious investors. Sometimes the best strategy is simply being where your competitors aren't looking.

Disclaimer: This analysis is for informational purposes only and does not constitute financial or investment advice. Always conduct your own research and consult with qualified financial professionals before making investment decisions.

Sources

Primary Financial Data:

Nu Holdings Ltd. Q1 2025 Financial Results and SEC Filings

Chime Financial Inc. Form S-1 Registration Statement, SEC Filing (May 2025)

WeBank Co. Ltd. Annual Reports and The Asian Banker Awards Data (2022-2025)

TymeBank Series D Funding Announcements (December 2024)

Revolut Ltd. 2024 Annual Report

Industry Analysis and Market Data:

The Asian Banker Excellence in Retail Financial Services Awards 2025

Reuters: "Brazilian digital lender Nubank invests $150 million in Tyme Group" (December 17, 2024)

TechCrunch: "African digital bank Tyme raises $250M round led by Nubank at $1.5B valuation" (December 19, 2024)

Endeavor: “Nubank Leads Tyme’s $250M Series D. Here’s the Story.” (December 18, 2024)

PYMNTS: "Chime Sets Sights on the Affluent Consumer and an $86 Billion Revenue Opportunity" (May 2025)

McKinsey: "WeBank makes financial services available to the masses through AI" (August 2022)

Mordor Intelligence: Asia-Pacific Neo Banking Market Analysis (2025)

Fintech Singapore: "There Are Only 11 Profitable Challenger Banks In Asia" (March 2024)

Regulatory and Corporate Filings:

U.S. Securities and Exchange Commission (SEC) EDGAR Database

Singapore Exchange (SGX) and Hong Kong Stock Exchange filings

Central Bank of Brazil regulatory reports

Various company investor relations materials and press releases

Great analysis.

There is great lack of knowledge of what Nubank is building. With the efficiency ratios they command and ROE they are able to invest in the customer at laser speed.

The Tyme move is o e of the best strategic signals Nu is going East at scale and know one is noticing. Tyme leadership has a similar DNA 🚀