Nubank dismantled Brazil's banking oligopoly. Here's how they do it.

Q2 2025: $3.7B revenue, 28% ROE, 122.7M customers. A forensic analysis of competitive destruction through cost structure optimization.

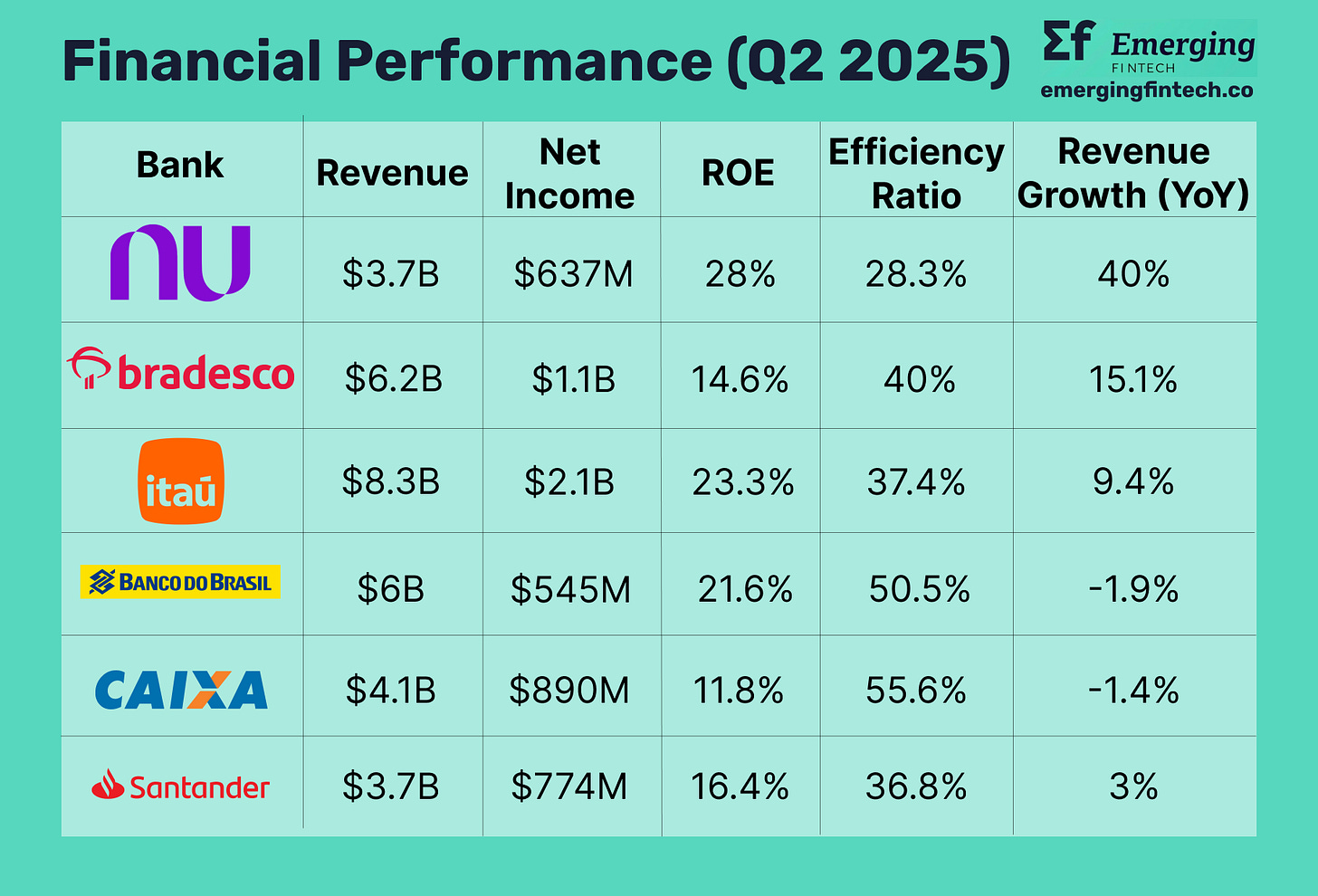

In the high-stakes world of Brazilian banking, where a handful of giants have long dominated, Nubank has emerged as a disruptive force of unprecedented scale. The fintech's Q2 2025 results were a declaration of victory: $3.7 billion in revenue, $637 million in net income, and a remarkable 28% return on equity (ROE). With 106.5 million customers in Brazil alone, Nubank has fundamentally broken the country's banking oligopoly.

The secret to this disruption lies in a systematic dismantling of the cost structures that traditional banks once considered their greatest strengths. By reimagining banking's core economics, Nubank has achieved an efficiency ratio of 28.3%, giving it a stunning 8 to 27 percentage point advantage over its competitors. This is not a marginal improvement, but a structural schism that compounds with scale.

The magnitude of this transformation becomes clear when comparing Nubank's performance against Brazil's banking establishment across key financial metrics.

While Nubank's absolute revenue and net income are still catching up, its performance metrics reveal a company on an unstoppable trajectory. It is growing revenue at 40% YoY, more than double its closest competitor, while its 28% ROE demonstrates best-in-class capital efficiency. Most critically, its 28.3% efficiency ratio is a structural advantage that turns every dollar of growth into profit far more effectively than any incumbent.

Let's examine how Nubank achieved this by systematically winning across the four cost pillars that traditional competitors cannot replicate.

Welcome to Emerging Fintech 👋🏻, your weekly deep dive into venture capital and fintech across emerging markets. If someone forwarded this to you, subscribe to get insights like this delivered weekly.

This edition is sponsored by Angel Squad - Join 2,000+ members from Apple, Nike, Stripe & Meta learning Hustle Fund's proven frameworks. Access curated deals from our 1,000+ monthly pipeline (we share the top 0.5%), weekly live pitch sessions, and global networking in 20+ cities. Squad members have invested $30M+ in 70+ companies alongside Hustle Fund. Start your 30-day free trial → https://go.angelsquad.co/gBk0

The four cost pillars: Nubank's blueprint for disruption

Nubank's transformation of Brazilian banking comes from a forensic reimagining of the industry's cost structures. Where traditional banks saw moats in their branch networks and regulatory history, Nubank saw liabilities in the digital age. This four-pillar framework unpacks how Nubank systematically turned each of the incumbents' perceived strengths into a weakness.

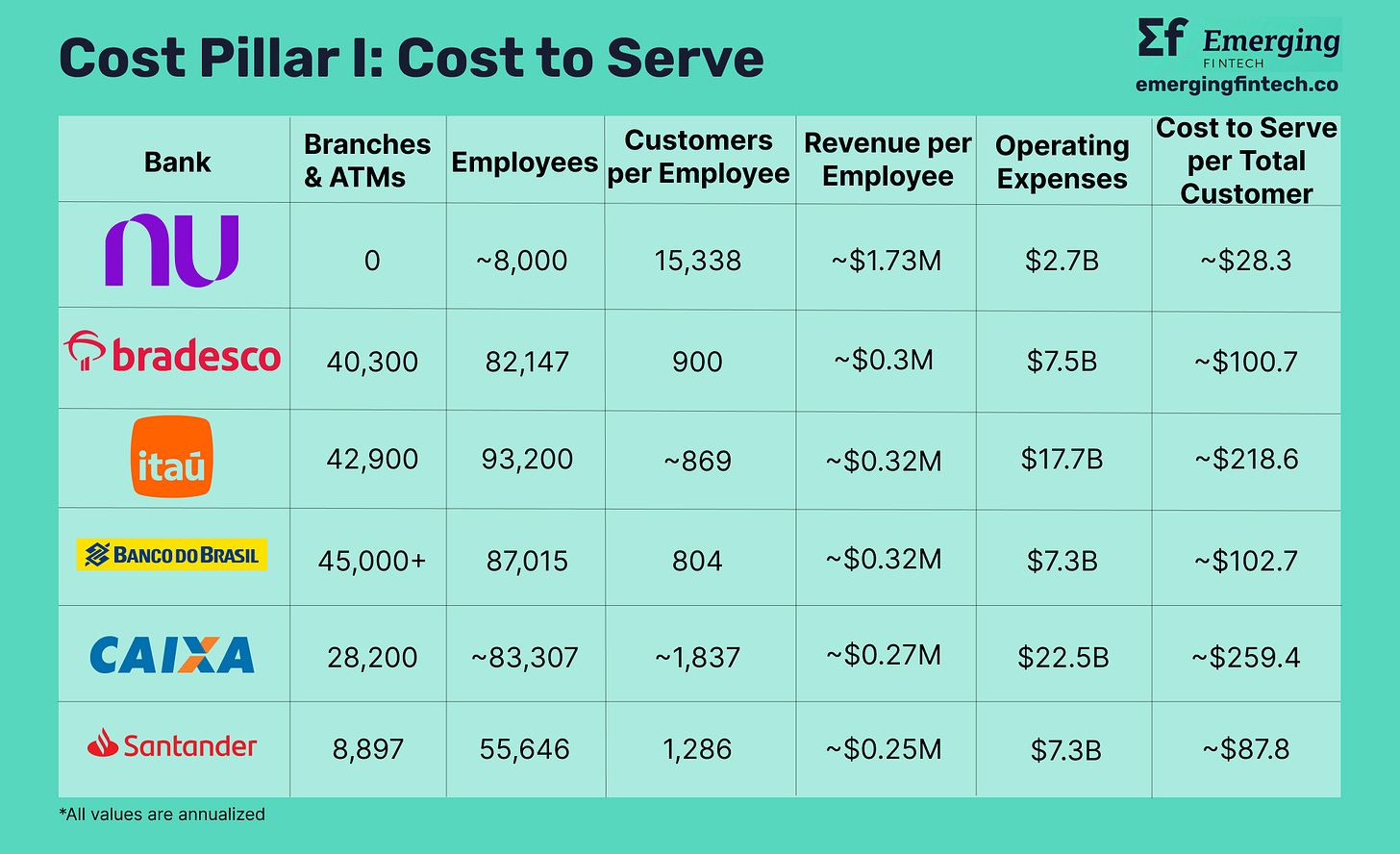

Cost pillar I: Cost to serve - digital architecture vs. legacy burden

TThe numbers reveal the true magnitude of Nubank's architectural advantage. With zero physical branches and just 8,000 employees serving 106.5 million customers in Brazil, Nubank has created a cost structure that traditional banks cannot match without abandoning their core business model. Each Nubank employee serves 15,338 customers while generating approximately $1.73 million in annualized revenue. This level of productivity exposes the fundamental inefficiencies of branch-based banking.

In contrast, Bradesco's 82,147 employees each serve only 900 customers and generate just $0.3 million in revenue. This 20x difference in customer service efficiency and 5x difference in revenue per employee isn't just about being lean. It represents a fundamentally different operating model that scales exponentially rather than linearly. When Nubank adds customers, the marginal cost approaches zero. When traditional banks add customers, they often need more branches, more staff, and more infrastructure.

The Cost to Serve metric crystallizes this advantage. At approximately $28.3 per customer annually, Nubank operates at a fraction of the cost of incumbents. Itaú's $218.6 per customer annually reflects the enormous burden of maintaining 42,900 branches and ATMs, while Caixa's $259.4 annually stems from its social banking mandate and massive physical footprint. These are not simply operational inefficiencies that can be optimized away, but rather structural constraints embedded in legacy business models.

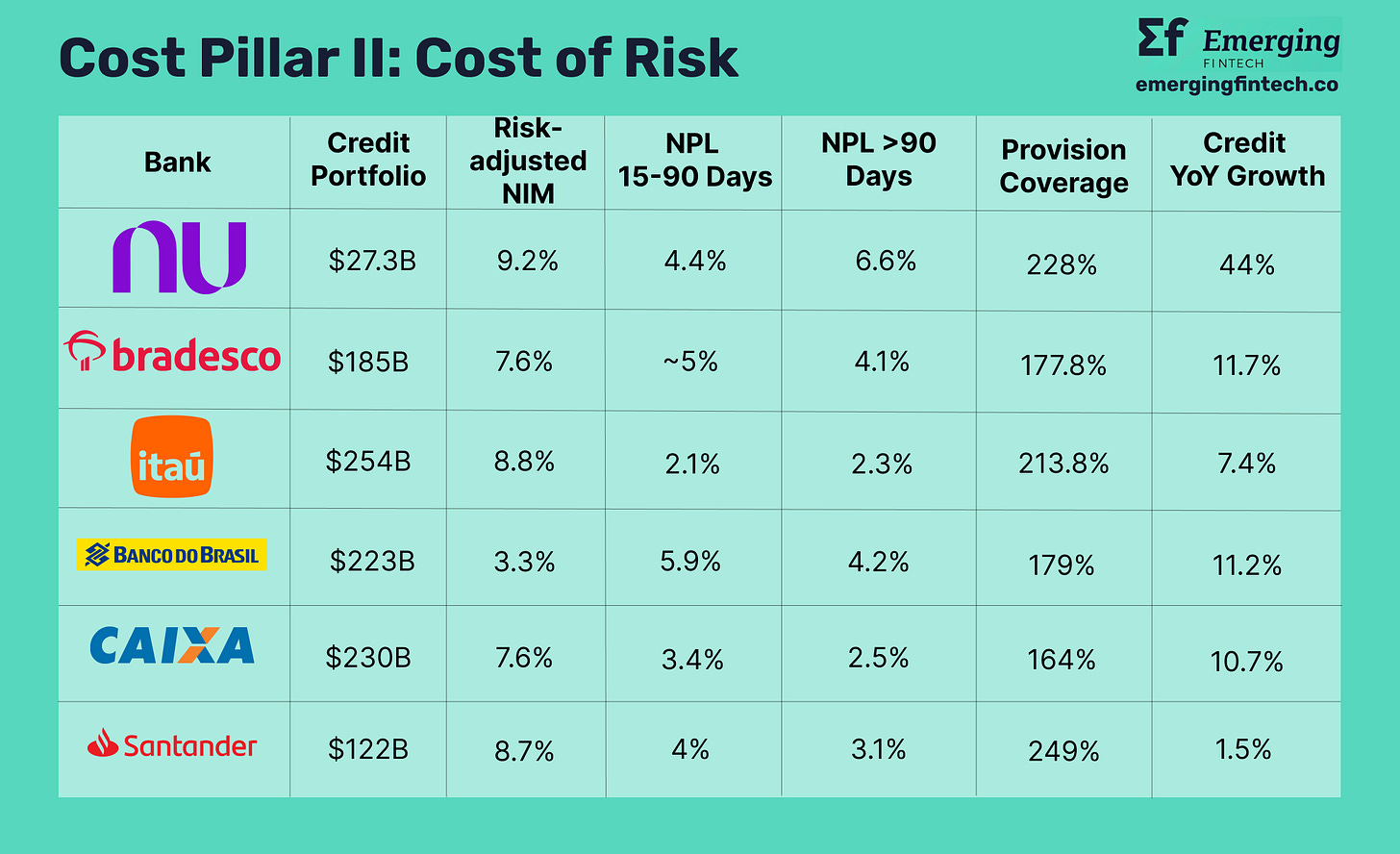

Cost pillar II: Cost of risk - data-driven precision underwriting

Nubank's approach to risk management demonstrates how superior data analytics can transform traditional banking economics. While its NPL >90 days ratio of 6.6% appears higher than some competitors, this reflects a strategic choice to serve underbanked populations that traditional banks have historically excluded. The crucial insight lies in Nubank's 228% provision coverage ratio, the highest among major competitors, which shows the company proactively manages risk rather than simply avoiding it.

This conservative provisioning enables Nubank to achieve a risk-adjusted Net Interest Margin (NIM) of 9.2%, the best in the sector. Compare this to Banco do Brasil's 3.3% risk-adjusted NIM, which suggests the state-owned bank is taking on risk without adequate compensation. Nubank's 44% credit growth, the fastest among peers, proves that superior risk models enable both growth and profitability simultaneously.

The data advantage compounds over time. Every transaction, every interaction, and every payment creates additional data points that improve Nubank's underwriting models. Traditional banks have transaction data, but they lack the integrated view that comes from controlling the entire customer experience through a single digital platform. This data moat deepens with scale, creating a virtuous cycle where better data enables better risk pricing, which attracts more customers and in turn generates more data.

Enjoying this article? Hit the share button to spread the word.

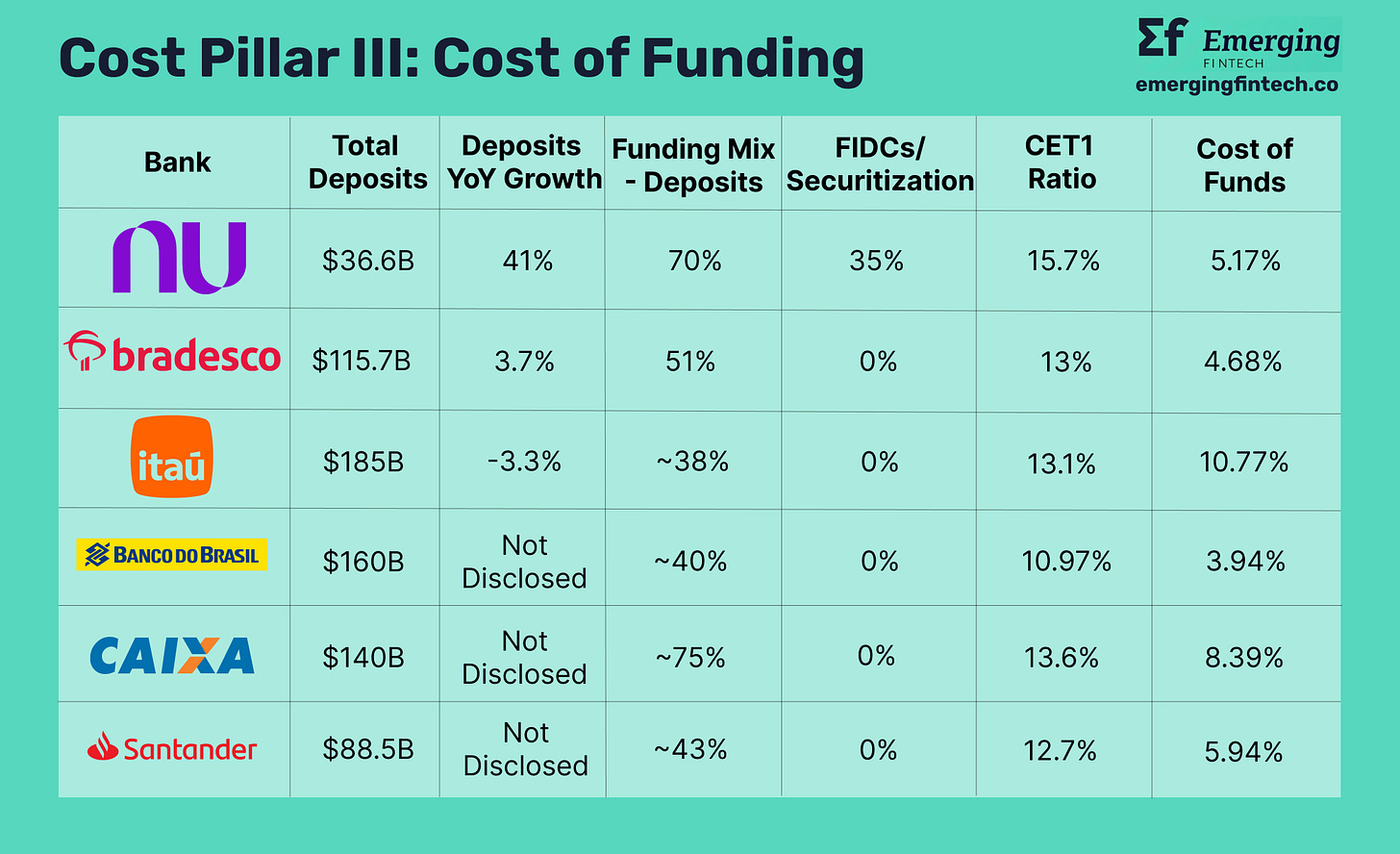

Cost pillar III: Cost of funding - diversified and efficient capital

Nubank has revolutionized banking funding by breaking the industry's dependence on expensive retail deposits gathered through branch networks. Its unique use of FIDCs (securitized credit funds) for 35% of funding represents a structural innovation that traditional banks cannot easily replicate. This diversification allows Nubank to access institutional capital markets directly, reducing its funding costs and insulating it from the operational expenses of gathering retail deposits.

At 5.17%, Nubank's cost of funds compares favorably to most competitors, despite being higher than Banco do Brasil's government-subsidized 3.94% rate. More importantly, Nubank's funding model scales without the linear cost increases that plague branch-based deposit gathering. When traditional banks need more funding, they often must open more branches, hire more staff, and offer higher deposit rates. In contrast, Nubank can access capital markets directly.

The 15.7% CET1 ratio, highest among peers, provides strategic flexibility and lowers the cost of both regulatory capital and market funding. This capital strength becomes self-reinforcing as Nubank's growth generates internal capital, reducing dependence on external funding sources over time.

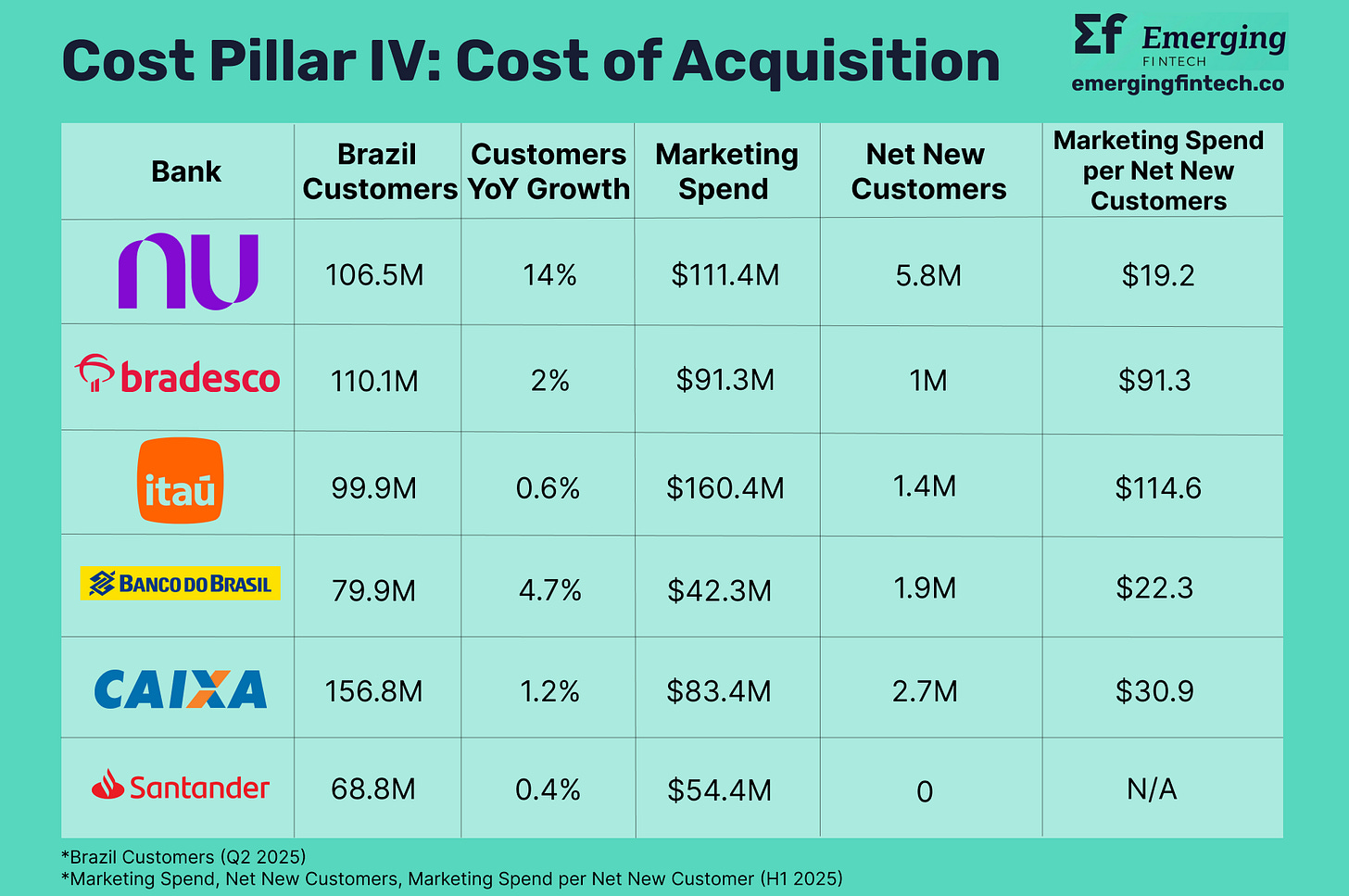

Cost pillar IV: Cost of acquisition - the viral growth engine

The customer acquisition metrics reveal perhaps the most devastating advantage in Nubank's arsenal. At $19.2 per net new customer, Nubank acquires customers at a fraction of the cost of traditional banks. Bradesco spends $91.3 per net customer acquisition, while Itaú spends $114.6. Most tellingly, Santander spent $54.4 million in the first half of 2025 only to achieve zero net customer growth, indicating its marketing budget was entirely consumed by offsetting churn.

This efficiency stems from Nubank's product-led growth model, where a superior user experience creates organic viral effects. When customers love the product, they become brand ambassadors, which reduces the need for paid marketing. Traditional banks must pay continuously for customer acquisition because their products do not create the same organic advocacy. This creates a compounding disadvantage where incumbents must spend more to achieve less.

The 5.8 million net new customers Nubank added in the first half of 2025 represent not just growth, but capital-efficient growth. Each new customer acquired at $19.2 will likely generate hundreds of dollars in lifetime value, creating a massive return on marketing investment that traditional competitors cannot match.

The unstoppable flywheel: How four pillars create insurmountable moats

When analyzed in isolation, each cost pillar represents a significant competitive advantage. Together, they create a self-reinforcing flywheel that becomes increasingly difficult for competitors to disrupt. The digital architecture enables superior data collection, which improves risk pricing. This in turn attracts more customers at lower costs, which generates more data, reduces per-customer service costs, and enables even better pricing and products.

This flywheel effect explains why Nubank's advantages are widening rather than narrowing. The 28.3% efficiency ratio is more than a metric; it is the output of a system where each additional customer makes the entire platform more efficient. Traditional banks face the opposite dynamic. Each new customer increases their operational complexity and cost base, creating diseconomies of scale in a digital world.

The moats surrounding this system are multifaceted. The data moat grows stronger with every transaction. The cost moat deepens as fixed technology investments are spread across more customers. The brand moat strengthens as customer satisfaction creates organic growth. Most importantly, the strategic moat widens as traditional competitors face the innovator's dilemma. They cannot abandon their branch networks without losing existing customers, yet maintaining them ensures a permanent cost disadvantage.

Like this article? Subscribe for more fintech analysis.

Investment analysis: Platform economics in public markets

With Nubank trading at approximately $14.95 per share as of late 2025, representing a market capitalization of roughly $71.6 billion, investors face a valuation that reflects both tremendous growth potential and execution risk. The stock's assessment requires understanding that Nubank operates on platform economics rather than traditional banking metrics, making conventional valuation approaches inadequate.

The bullish scenario centers on Nubank's ability to expand its economic moats while capturing more value per customer. As the company penetrates secured lending, insurance, and investment products, its Average Revenue Per Active Customer (ARPAC) should grow from the current $12.2 toward the $25-30 range achieved by mature digital platforms. The 40% revenue growth rate, combined with expanding margins from operational leverage, could sustain 25-30% annual earnings growth for several years. In this scenario, the premium valuation is justified by software-like margins and network effects that traditional banks cannot replicate.

However, the incumbent response poses the primary risk to this thesis. Itaú Unibanco has emerged as the most credible digital challenger by migrating 60% of its infrastructure to AWS and developing over 1,300 AI models through its partnership with Stanford's Human-Centered AI Institute. The bank's $18 million investment in NeoSpace, a generative AI startup, and its comprehensive digital transformation have reduced customer-impacting incidents by 98% while cutting deployment cycles from months to days. With 17,000 technology professionals, including 5,900 AWS-certified engineers, Itaú is building the technical capabilities to compete with Nubank's digital advantages.

Bradesco's response has been equally aggressive. The bank's AI assistant, BIA, now handles millions of customer interactions with an 82% first-level resolution rate, while generative AI integration has increased manager usage 8x. The partnership with Microsoft Azure has enabled Bradesco to achieve 89% customer retention rates in digital channels, directly competing with Nubank's customer experience advantages. These efforts represent more than incremental improvements, signaling a fundamental shift in how traditional banks approach technology.

Banco do Brasil's partnership with Mila, Quebec AI Institute, and its expansion of AI solutions by 130% over three years demonstrate that even state-owned incumbents are investing heavily in digital capabilities. The bank's integration of generative AI for micro and small business recommendations, combined with automated identity verification systems that save over 40 hours of work per customer, shows how incumbents are leveraging their existing customer relationships and data assets.

The bear case acknowledges that these digital initiatives could slow Nubank's market share gains more than expected. If traditional banks successfully reduce their cost-to-serve through AI and automation while leveraging their massive customer bases for cross-selling, Nubank's growth premium could compress significantly. A prolonged economic downturn in Brazil would also disproportionately impact Nubank's loan portfolio, given its focus on previously underbanked customers.

The base case assumes gradual market maturation where Nubank maintains its structural advantages while facing increased competition from digitally transformed incumbents. Revenue growth moderates to the 20-25% range as the Brazilian market saturates, but expanding ARPAC and international growth in Mexico and Colombia sustain premium valuations. The efficiency gap remains significant but stabilizes as incumbents achieve partial digital transformation.

For investors, the key variables are the speed of incumbent digital transformation and Nubank's ability to expand internationally and into new product categories. The company's systematic approach to dismantling traditional banking cost structures provides a durable competitive advantage, but the ultimate valuation will depend on how effectively traditional banks can respond with their own digital transformations.

Conclusion: The new rules of banking

Nubank's systematic dismantling of Brazil's banking oligopoly reveals a fundamental truth that the old moats have become anchors. This optimization across four pillars, resulting in a 95% lower cost to serve, 5x better unit economics, unique funding access, and viral growth, creates competitive advantages that are not just sustainable but also expanding.

The data speaks definitively. With a 28% ROE and 28.3% efficiency ratio, Nubank is not just winning but rewriting the rules of the game. Traditional banks, burdened by their physical infrastructure and legacy technology, face the innovator's dilemma. They cannot abandon their old models without alienating existing customers, yet maintaining them ensures a permanent cost disadvantage.

Yet the competitive response is real and accelerating. The incumbents' massive investments in AI, cloud computing, and digital transformation represent more than defensive measures; they signal a recognition that the future of banking will be determined by technological capability rather than regulatory protection or physical presence. The question is no longer whether digital transformation is necessary, but whether it can be executed quickly enough to close the gap with Nubank's native advantages.

This transformation extends beyond Brazil. Across global financial markets, the institutions that master platform economics, data-driven decision-making, and viral customer acquisition will define the next era of banking. For investors, this represents not just a sector rotation but a fundamental shift from industrial-age banking to platform-age financial services. The winners will be those who recognize that in the digital economy, the most efficient platforms capture disproportionate value, while legacy players face inexorable margin compression.

Nubank operates on platform economics while its competitors remain bound by industrial-age constraints. This transformation goes beyond disruption to represent a secular shift toward a future where the most efficient platforms dominate financial services. The companies that adapt to these new rules will thrive; those that do not will find themselves increasingly irrelevant in a world where customers expect banking to be as seamless as any other digital experience.

If you found value in this analysis, share it with your friend and subscribe for weekly fintech insights.

Disclaimer: This analysis is for informational purposes only and does not constitute financial or investment advice. Always conduct your own research and consult with qualified financial professionals before making investment decisions.

Sources:

Nu Holdings Ltd. Q2 2025 Financial Results and SEC Filings

Itaú Unibanco Q2 2025 Earnings Reports

Banco Bradesco Q2 2025 Financial Statements

Banco do Brasil Q2 2025 Results

Santander Brasil Q2 2025 Financial Reports

Caixa Econômica Federal Q1 2025 Results (latest available)

Market cap data from Yahoo Finance (September 2025)

Bank ranking from Banco Central do Brasil (September 2025)

Exchange Rate Note: All BRL figures converted to USD using 5.5 BRL = 1 USD (approximate Q2 2025 exchange rate) for consistent analysis across all banks.